Renting vs. Buying: Why Now Might Be the Perfect Time to Make the Move

2024 Housing Market

2024 Housing Market

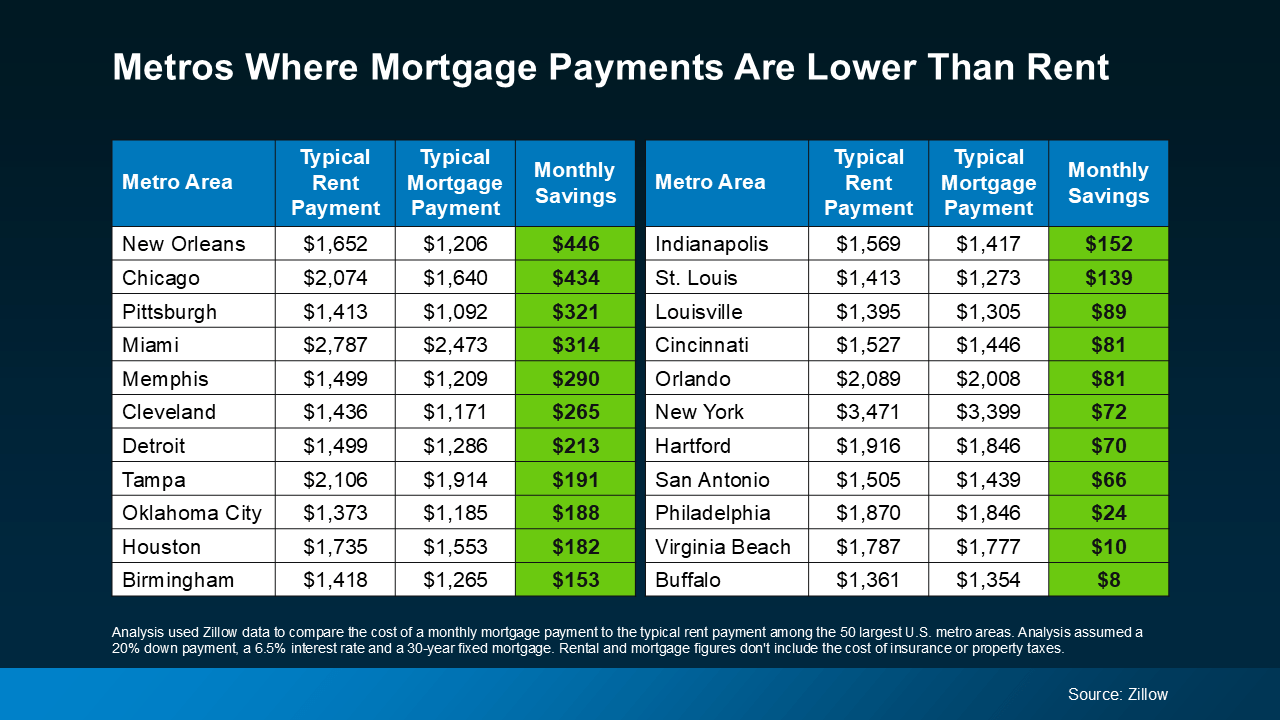

That’s right—according to a recent study from Zillow, in 22 of the 50 largest metro areas, monthly mortgage payments are now lower than rent payments (see chart below):

As mortgage rates have eased off their recent peak, home prices have moderated, and inventory has ticked up, affordability has improved significantly. When you add all of that up, it’s getting less expensive to buy a home than to rent one in many parts of the country.

As mortgage rates have eased off their recent peak, home prices have moderated, and inventory has ticked up, affordability has improved significantly. When you add all of that up, it’s getting less expensive to buy a home than to rent one in many parts of the country.

This is a big deal if you’ve been renting for a while now. But if you don’t see your city on this list, don’t sweat it. Things are moving fast, and your area might be joining these top metros soon.

You see, talking with a local real estate agent about what’s happening in your market before this happens in your ideal neighborhood could really change the game for you. It’s all about being informed by a true expert, and understanding what was out of reach before might actually be getting more affordable than you think.

Now, while this study compares monthly rent to principal and interest on a mortgage payment (not the whole monthly payment), let’s think through this. As Zillow notes, what you can’t ignore when you buy a home are things like taxes, insurance, utilities, and maintenance that should also be factored into your budget and your monthly payment.

But remember – renters pay extra fees too, like renters’ insurance, utilities, parking, and more. And while doing the math may feel like a drag, this equation could be a much more exciting one to work through today.

So, grab your calculator and your agent because the big takeaway is this: it may be time to determine if you’re in a spot to afford what you couldn’t just a few months ago.

As Orphe Divounguy, Senior Economist at Zillow, says:

“… for those who can make it work, homeownership may come with lower monthly costs and the ability to build long-term wealth in the form of home equity — something you lose out on as a renter. With mortgage rates dropping, it's a great time to see how your affordability has changed and if it makes more sense to buy than rent.”

Whether you live in one of these budget-friendly metros where the scales have already tipped in your favor, or any town in-between, it’s time to connect with a local real estate agent to get the conversation started.

With mortgage rates coming down and more homes hitting the market, you’ll want to be ready to jump back into your search – before everyone else does.

Renting versus buying is an age-old debate, and the current market dynamics could make this the turning point that tips the scales toward buying for many people. With rising rent prices and historically low inventory driving up costs across many cities, buying is becoming increasingly attractive. Even in budget-friendly metros where rent was once a more economical option, the balance is shifting. Homeownership not only builds equity but also offers stability, control over your living situation, and the potential for long-term financial gain.

If you're considering the pros and cons, now is the perfect time to explore your options and see if buying aligns better with your goals. Whether you're in a city where the market already favors buying or in any town across the spectrum, let’s connect. At Avant ONE Real Estate, we’re here to discuss your unique situation and explore how we can turn the current market dynamics to your advantage.

Stay up to date on the latest real estate trends.

critical choices when selling a home

Why Skipping Preparation Is Costing Sellers in Westlake Village and Thousand Oaks More Than They Realize

home selling strategies

How strategic, high-ROI updates can help your home stand out, attract serious buyers, and protect your equity in today’s market.

Westlake Village Market Trends

What the Last 30 Days Reveal for 2026 Sellers

2025 Housing Market

California’s 2026 Real Estate Landscape Is Changing — Here’s What Matters Most

2025 Housing Market

Even with headlines about falling prices, most homeowners are sitting on record-high equity — and that’s what really matters

home seller tips

Don’t be dazzled by flashy marketing or inflated online reviews — learn how to verify who you’re really hiring.

Home Pricing Strategy

Understanding how misused data, time bias, and misplaced confidence can cost sellers thousands — and how the right pricing strategy positions your home for success.

home selling strategies

Ways to reduce your taxable gain and keep more of what you’ve earned.

informed decisions for seniors

Because transitions deserve guidance, not guesswork — and the right partners make all the difference.

You’ve got questions and we can’t wait to answer them.