Now Is the Perfect Time To Upgrade to Your Dream Home in Ventura County

move up buyer

move up buyer

If you’ve been thinking about selling your home to upgrade to a larger, more luxurious space, you’re not alone—and if you’re living in sought-after communities like Westlake Village, Thousand Oaks, or Calabasas, the timing couldn’t be better.

However, like many others, you might have been holding off due to recent market challenges. It’s understandable—upgrading to a bigger home often comes with increased monthly costs, and affordability is always a key factor. But here’s the good news: now may be the ideal moment to make your move, and here’s why your local market is ripe with opportunity.

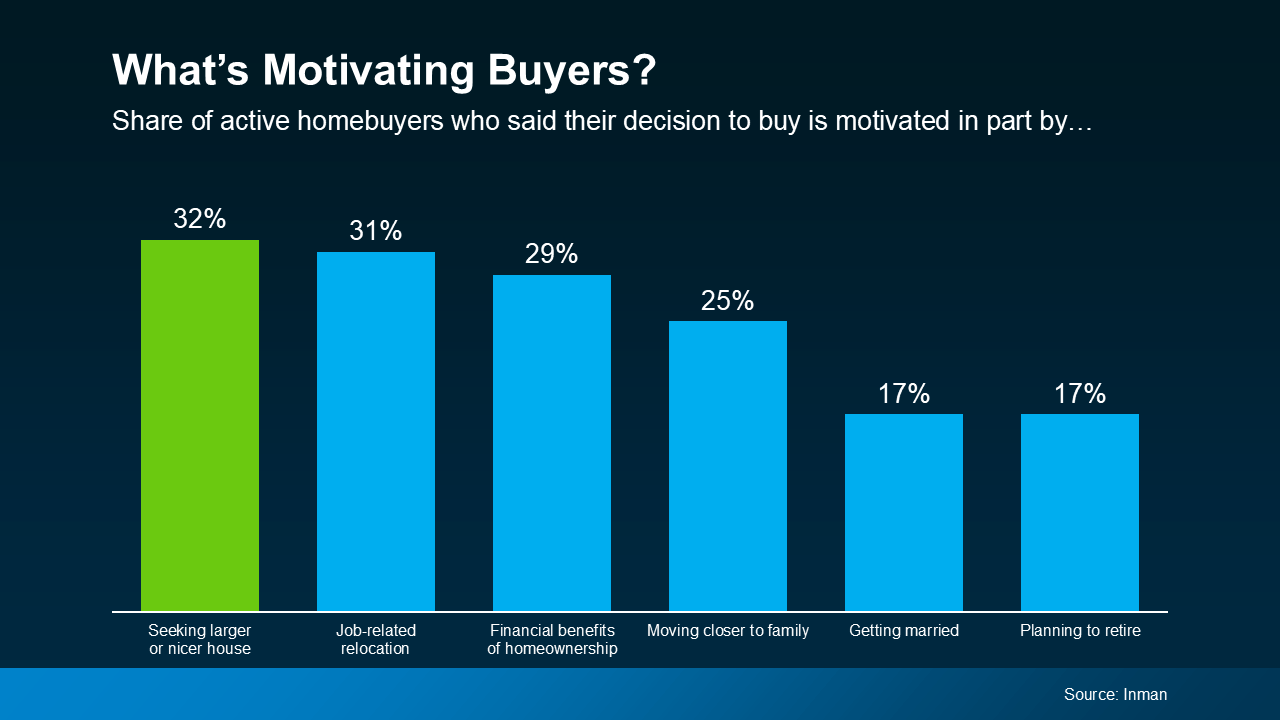

If you’ve been wanting to sell your house and move up to a bigger or nicer home, you’re not alone. A recent Inman survey reveals that the top motivator for today’s buyers is the desire for more space or a nicer home. In Ventura County and the Northwest Los Angeles area, the desire for upgraded living is on the rise, with more buyers seeking properties that offer a perfect blend of comfort, lifestyle, and value.

But There’s also a good chance you, like many other people, have been holding off on that goal because of recent market challenges. It makes sense – when you’re planning an upgrade that could increase your monthly housing costs, affordability has a huge impact on when you make your move. But there’s good news: now’s actually a great time to make that move happen. Here’s why.

But There’s also a good chance you, like many other people, have been holding off on that goal because of recent market challenges. It makes sense – when you’re planning an upgrade that could increase your monthly housing costs, affordability has a huge impact on when you make your move. But there’s good news: now’s actually a great time to make that move happen. Here’s why.

One of the key benefits in today’s market is the amount of equity you’ve likely built up in your current house over the years. Even with recent shifts in the housing market, national home prices have steadily grown, adding to the equity homeowners have today. Selma Hepp, Chief Economist at CoreLogic, explains it well:

“Persistent home price growth has continued to fuel home equity gains for existing homeowners who now average about $315,000 in equity and almost $129,000 more than at the onset of the pandemic.”

What does that mean for you? If you’ve been in your home for a few years, you’re probably sitting on a significant amount of equity. You can put that toward the down payment on your next home, helping keep the amount you borrow within a comfortable range.

This can make upgrading more achievable than you might think. If you’re curious how much you’ve built up over the years, ask your real estate agent for a professional equity assessment.

And there’s another big reason why now’s a great time to make your move: mortgage rates are trending down. Lower rates can help make your future monthly payments more manageable, and they also increase your purchasing power. As Nadia Evangelou, Senior Economist and Director of Real Estate Research at the National Association of Realtors (NAR), points out:

“When mortgage rates fall, the interest portion of monthly payments decreases, which lowers the total payment. This makes it easier for more borrowers to . . . qualify for mortgages that may have been unaffordable at higher rates.”

That gives you more flexibility when shopping for homes and may allow you to afford a house at a price point that was previously out of reach. A trusted lender can work with you to figure out the best plan for your budget.

Whether you're eyeing a luxury home near Lake Sherwood, a peaceful retreat in North Ranch, or something with panoramic views in Agoura Hills, let’s explore how you can leverage your equity and take advantage of today’s market conditions to upgrade your living situation in style.

Stay up to date on the latest real estate trends.

critical choices when selling a home

Why Skipping Preparation Is Costing Sellers in Westlake Village and Thousand Oaks More Than They Realize

home selling strategies

How strategic, high-ROI updates can help your home stand out, attract serious buyers, and protect your equity in today’s market.

Westlake Village Market Trends

What the Last 30 Days Reveal for 2026 Sellers

2025 Housing Market

California’s 2026 Real Estate Landscape Is Changing — Here’s What Matters Most

2025 Housing Market

Even with headlines about falling prices, most homeowners are sitting on record-high equity — and that’s what really matters

home seller tips

Don’t be dazzled by flashy marketing or inflated online reviews — learn how to verify who you’re really hiring.

Home Pricing Strategy

Understanding how misused data, time bias, and misplaced confidence can cost sellers thousands — and how the right pricing strategy positions your home for success.

home selling strategies

Ways to reduce your taxable gain and keep more of what you’ve earned.

informed decisions for seniors

Because transitions deserve guidance, not guesswork — and the right partners make all the difference.

You’ve got questions and we can’t wait to answer them.