Renting vs. Buying in Westlake Village & Thousand Oaks: The Wealth Gap You Need To Know

rent vs buy

rent vs buy

Trying to decide between renting or buying a home in Westlake Village, Thousand Oaks, or anywhere in Ventura County? A key factor that might help you decide is the potential of homeownership to grow your net worth.

Every three years, the Federal Reserve Board releases a report called the Survey of Consumer Finances (SCF), highlighting the differences in wealth between homeowners and renters. The findings are striking and can be eye-opening for those considering a shift to homeownership.

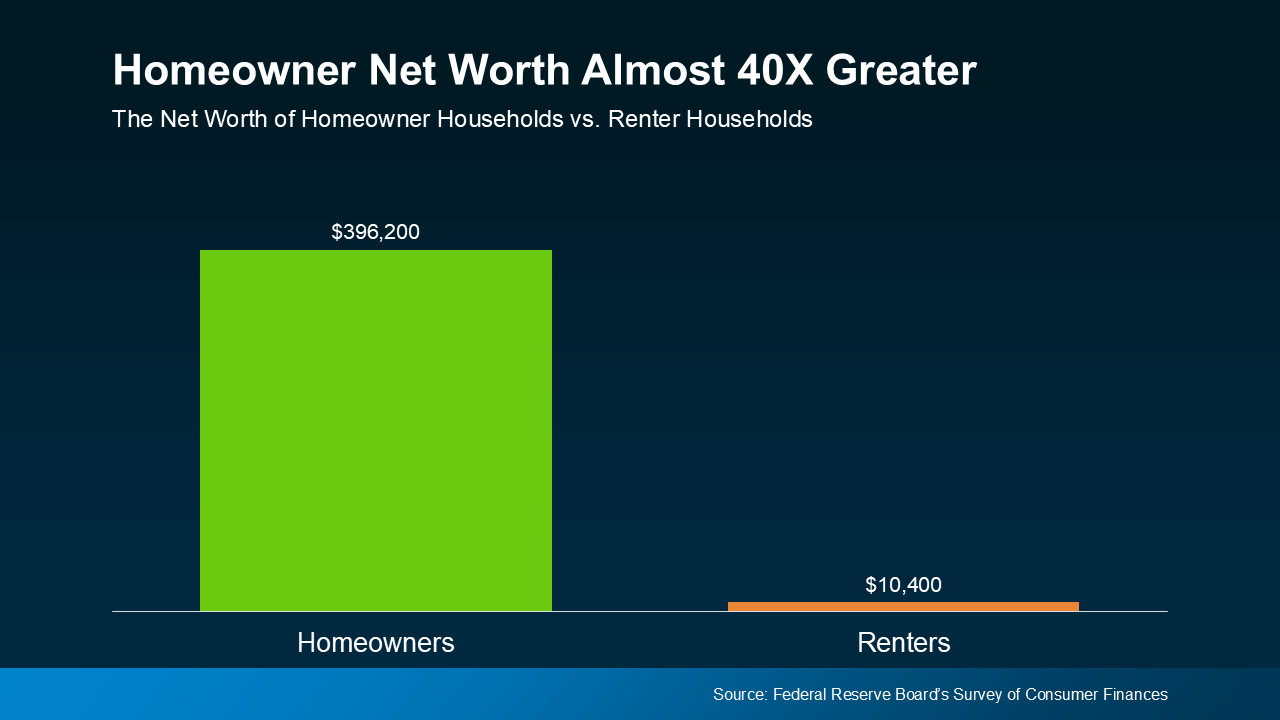

On average, homeowners have nearly 40 times the net worth of renters. Take a look at the graph below to visualize this gap:

In a recent report, the average homeowner’s net worth was around $255,000, while the average renters net worth was just $6,300. That’s a huge difference. And with the latest data, this wealth gap has only widened further as home values continue to increase as shown below.

If you’re debating whether to rent or buy, it’s worth noting that while there has been some improvement in housing inventory this year, demand still generally outpaces supply in most parts of Ventura County, including Westlake Village and Thousand Oaks. Expert predictions suggest home prices will continue to rise in 2024, albeit at a more moderate pace.

This expected appreciation may not match the highs of the pandemic years, but it still offers the potential for future equity gains if you decide to buy a home now. Economist Ksenia Potapov of First American points out:

“Despite the risk of volatility in the housing market, homeownership remains an important driver of wealth accumulation and the largest source of total wealth among most households.”

But keep in mind that real estate trends vary widely by location. For a personalized view of the Ventura County housing market, connect with a local real estate expert. They can offer insights into home prices, market trends, and other financial benefits unique to homeownership in our area, helping you make a more informed choice.

As Bankrate puts it:

“Deciding between renting and buying a home isn’t just about cost — the decision also involves long-term financial strategies and personal circumstances. If you’re on the fence about which is right for you, it may be helpful to speak with a local real estate agent who knows your market well. An experienced agent can help you weigh your options and make a more informed decision.”

According to the SCF:…the 2019-2022 growth in median net worth was the largest three-year increase in the history of the modern SCF, more than double the next-largest increase on record.”

One of the main reasons homeowner wealth surged is due to home equity.

Home equity is the difference between what your home is worth and what you owe on it. This equity builds as you pay down your mortgage and as your property’s value increases. For many in Ventura County, where home values have seen steady appreciation, this has meant a substantial increase in their overall net worth.

Over recent years, Ventura County, like many areas in California, experienced significant home price growth. This rise was largely due to a limited number of homes available for sale while demand remained high, pushing prices up and, as a result, increasing homeowners’ equity.

If you’re unsure whether to rent or buy, remember that, if it’s financially feasible, owning a home in Westlake Village, Thousand Oaks, or anywhere in Ventura County can significantly boost your wealth over time.

Ready to start building your future wealth through homeownership? Whether you're curious about market trends in Ventura County or need guidance on financing options, let’s chat! Connect with us today to discover how owning a home in Westlake Village, Thousand Oaks, or the surrounding area can put you on the path to financial success. Don’t wait—reach out and take the first step toward a more secure, prosperous future!

Stay up to date on the latest real estate trends.

critical choices when selling a home

Why Skipping Preparation Is Costing Sellers in Westlake Village and Thousand Oaks More Than They Realize

home selling strategies

How strategic, high-ROI updates can help your home stand out, attract serious buyers, and protect your equity in today’s market.

Westlake Village Market Trends

What the Last 30 Days Reveal for 2026 Sellers

2025 Housing Market

California’s 2026 Real Estate Landscape Is Changing — Here’s What Matters Most

2025 Housing Market

Even with headlines about falling prices, most homeowners are sitting on record-high equity — and that’s what really matters

home seller tips

Don’t be dazzled by flashy marketing or inflated online reviews — learn how to verify who you’re really hiring.

Home Pricing Strategy

Understanding how misused data, time bias, and misplaced confidence can cost sellers thousands — and how the right pricing strategy positions your home for success.

home selling strategies

Ways to reduce your taxable gain and keep more of what you’ve earned.

informed decisions for seniors

Because transitions deserve guidance, not guesswork — and the right partners make all the difference.

You’ve got questions and we can’t wait to answer them.